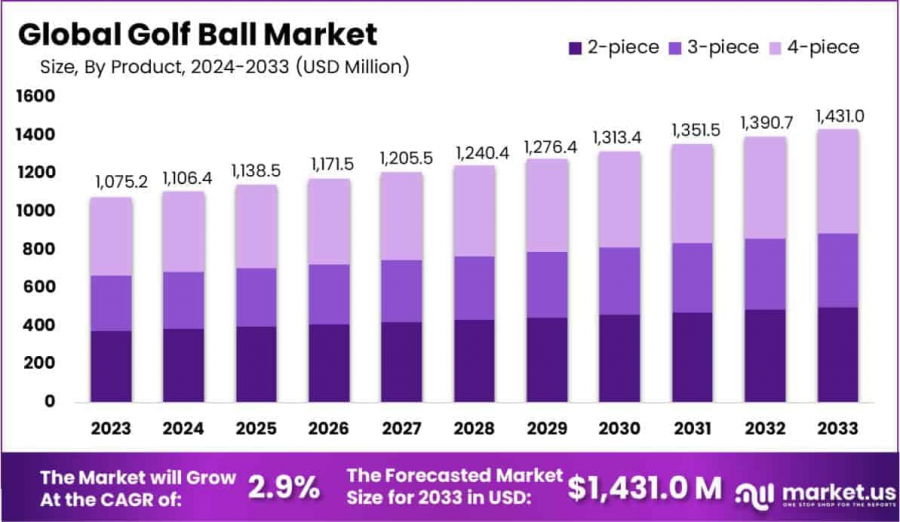

Golf Ball Market Share & Size to Reach USD 1,431.0 Million by 2033, Expanding at 2.9% CAGR

Golf Ball Market is projected to reach USD 1,431.0 Million by 2033, growing at a CAGR of 2.9% from 2024 to 2033.

NEW YORK, NY, UNITED STATES, January 29, 2025 /EINPresswire.com/ -- **Report Overview**

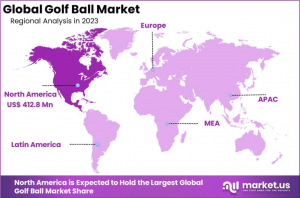

The Global Golf Ball Market is projected to reach USD 1,431.0 Million by 2033, up from USD 1,075.2 Million in 2023, growing at a CAGR of 2.9% from 2024 to 2033. North America held the largest share with USD 412.8 Million in 2023, accounting for 38.4% of the market.

A golf ball is a specially designed sphere used in the sport of golf, typically featuring a solid core surrounded by a durable outer cover with dimples to reduce air resistance and improve aerodynamic performance. Golf balls are manufactured to meet strict size, weight, and performance standards as outlined by governing bodies such as the United States Golf Association (USGA) and the Royal & Ancient Golf Club (R&A). The market for golf balls encompasses the production, distribution, and retail of these products, catering to both professional players and recreational golfers across various skill levels. It is influenced by factors such as technological advancements, player preferences, and overall trends within the broader sports industry.

The golf ball market has witnessed steady growth in recent years, driven by increasing participation in the sport, the rising popularity of golf among younger demographics, and the integration of innovative technologies aimed at enhancing performance. Additionally, the growing emphasis on premium golf equipment, which includes high-performance balls designed for specific player needs, further fuels market expansion. The surge in disposable income, particularly in emerging markets, also contributes to higher spending on golf-related products.

Request Your Sample Report Today for In-Depth Insights and Analysis at https://market.us/report/golf-ball-market/request-sample/

Demand for golf balls is significantly influenced by factors such as golf course accessibility, the popularity of golfing events, and advancements in golf ball technology, such as improved distance, accuracy, and durability. Furthermore, eco-friendly golf ball innovations are gaining traction as sustainability becomes a core consideration for both manufacturers and consumers. Opportunities for growth lie in emerging markets, the rise of golf as a recreational activity, and the development of specialized products for varying playing conditions and player preferences.

**Key Takeaways**

~~ The global golf ball market is projected to reach USD 1,431.0 Million by 2033, growing from USD 1,075.2 Million in 2023, at a CAGR of 2.9% during the forecast period (2024–2033).

~~ In 2023, 4-piece golf balls held the largest share in the product segment, commanding 38.3% of the market.

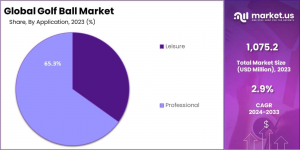

~~ The professional segment dominated the golf ball market in 2023, with a 65.3% market share.

~~ North America led the market in 2023, holding 38.4% of the market share and generating USD 412.8 Million in revenue.

**Market Segmentation**

In 2023, the 4-piece golf ball segment led the market with a 38.3% share, favored for its advanced performance, control, and spin, ideal for professional and low-handicap players. Close behind, the 3-piece segment captured 32.1% of the market, offering a balanced mix of distance, feel, and spin, popular among a wide range of players. The 2-piece segment, accounting for 29.6%, is preferred by recreational players and beginners due to its durability, increased distance, and affordability, making it the go-to choice for casual golfers.

In 2023, the Professional segment led the Golf Ball Market, holding a 65.3% share, driven by the growing number of professional tournaments and the demand for high-performance balls offering precision, distance, and durability. This segment favors advanced multi-layer balls for superior control and spin in competitive settings. Meanwhile, the Leisure segment made up 34.7% of the market, serving casual and amateur golfers who prioritize ease of use and affordability, with a preference for 2-piece balls designed for distance and durability. Despite its smaller share, the Leisure segment benefits from a broad consumer base, ensuring consistent demand.

**Key Market Segments**

Key Market Segments

By Product

~~ 2-piece

~~ 3-piece

~~ 4-piece

By Application

~~ Leisure

~~ Professional

**Driving factors**

Rising Participation in Golf

The increase in global golf participation is a significant driver for the growth of the golf ball market. The sport's growing appeal among a wider demographic—fueled by a rising interest in fitness and outdoor recreation—has expanded the consumer base. As golf’s popularity continues to soar in regions such as Asia-Pacific and Latin America, the demand for golf equipment, including golf balls, is expected to rise. This trend is particularly notable in developing countries, where golf courses and training facilities are becoming more prevalent.

"Order the Complete Report Today to Receive Up to 30% Off at https://market.us/purchase-report/?report_id=13181

**Restraining Factors**

Environmental Regulations and Sustainability Concerns

Despite growth, the golf ball market faces challenges stemming from sustainability concerns and stricter environmental regulations. Golf balls, being made from synthetic materials, pose environmental risks, particularly in terms of long decomposition periods in natural habitats. Increasing scrutiny and the push for greener alternatives are forcing manufacturers to rethink production methods, which may slow down growth in the short term as they navigate new eco-friendly innovations and meet regulatory requirements.

**Growth Opportunity**

Technological Advancements and Customization

Technological innovations offer significant opportunities in the golf ball market. The ongoing evolution of materials and manufacturing techniques has led to enhanced performance, including improvements in durability, distance, and spin control. Additionally, the increasing demand for customizations, such as personalized golf balls tailored to individual playing styles or branding purposes, opens up new revenue streams. Manufacturers can leverage these innovations to attract premium customers and gain a competitive edge in the evolving market landscape.

**Latest Trends**

Premiumization of Golf Balls

In recent years, the golf ball market has seen a clear shift toward premium products. Players are increasingly willing to invest in high-performance golf balls that offer greater accuracy, distance, and control. This trend is driven by the growing number of serious amateur players and the expanding professional market. As performance becomes a key focus, leading brands are positioning themselves to cater to this demand by introducing technologically advanced, premium-priced options designed to elevate the golfing experience.

**Regional Analysis**

North America: Lead Region with Largest Market Share in the Golf Ball Market (38.4% Market Share in 2023)

The Golf Ball market is witnessing substantial growth across various regions, with North America leading the global market. In 2023, North America accounted for a dominant market share of 38.4%, with a market size of approximately USD 412.8 million. The region's strong demand for premium and innovative golf balls, coupled with an established sporting culture and high consumer spending, drives this growth. The U.S. remains a key player due to its vast golf course infrastructure and the popularity of the sport. This dominance is further supported by the increasing interest in golf among younger demographics and evolving trends in golf ball technology.

Europe is a significant market for golf balls, driven by the sport's popularity in countries like the UK, Germany, and France. With a rich history in golf, Europe continues to see steady growth, supported by a strong golfing community and high-quality product demand. The European market is expected to grow as more golf courses are established, and the trend toward premium and customized golf balls gains traction. However, the market share is smaller compared to North America, contributing to an expanding yet competitive landscape.

The Asia Pacific region is experiencing rapid growth in the golf ball market, driven by emerging markets such as China, Japan, and South Korea. With an increasing number of golf enthusiasts, growing disposable income, and rising interest in recreational sports, the demand for golf balls in this region is expected to surge. Japan remains a key market, with a well-established golfing culture, while countries like China show significant growth potential due to a young, dynamic population interested in sports.

In the Middle East and Africa, the golf ball market is smaller but steadily growing. The United Arab Emirates, South Africa, and Morocco are key markets, with golf courses becoming more popular in these regions. The increasing interest in golf tourism and the development of world-class golfing destinations contribute to the growth of the market. However, the market is still in a nascent stage compared to North America and Europe.

Latin America represents a growing but relatively smaller market for golf balls, with countries like Brazil, Mexico, and Argentina leading the way. The region is seeing gradual growth due to rising interest in golf and a growing middle class. However, challenges such as economic volatility and limited access to golfing facilities in some areas continue to pose hurdles for faster growth. Despite these challenges, the market shows promise as golf becomes a more popular recreational activity.

!! Request Your Sample PDF to Explore the Report Format !!

**Key Players Analysis**

In 2024, the Global Golf Ball Market is expected to remain competitive, with key players such as Callaway Golf Co., TaylorMade Golf Co., and Bridgestone Golf driving innovation in technology and product performance. Callaway continues to dominate with its cutting-edge designs and premium offerings, while TaylorMade’s focus on personalized golf balls and high-performance standards has maintained its strong market position.

Bridgestone's expertise in custom golf ball fitting and technology further strengthens its presence. Meanwhile, brands like Dixon Golf, Mizuno, and Nike Golf, alongside emerging players like OnCore Golf Technology and Toppoint Corp., contribute diverse products catering to both professional and recreational golfers. Other key players in the market continue to enhance their portfolios through innovation and sustainability.

Top Key Players in the Market

~~ Callaway Golf Co.

~~ Dixon Golf, In

~~ Mizuno Corp.

~~ Nike Golf, Inc.

~~ TaylorMade Golf Co., Inc.

~~ Bridgestone Golf, Inc

~~ Sumitomo Rubber Industries Ltd

~~ OnCore Golf Technology Inc.

~~ Tee Ventures (India) Pvt. Ltd.

~~ Toppoint Corp. Ltd.

~~ Turner Broadcasting System, Inc.

~~ XXIO Golf

~~ Other Key Players

**Recent Developments**

~~ In June 2023, TaylorMade Golf Co., Inc. introduced the Tour Response PIX golf ball, featuring visual technology for better alignment and feedback, designed for both amateurs and professionals.

~~ In May 2023, Nike Golf, Inc. launched the AeroReact golf ball with a new dimple design aimed at improving aerodynamics and distance control, enhancing player performance by reducing drag and increasing lift.

~~ In April 2023, Bridgestone Golf, Inc. partnered with a leading tech firm to develop AI-enhanced golf balls, offering real-time data on spin rates and launch angles to optimize players' game strategy.

**Conclusion**

The global golf ball market is projected to reach USD 1,431.0 million by 2033, growing from USD 1,075.2 million in 2023, at a CAGR of 2.9%. North America leads the market, accounting for 38.4% of the share in 2023. The demand for golf balls is driven by increasing global participation in golf, particularly in emerging markets, and the growing preference for high-performance, premium products. Innovations in golf ball technology, including enhanced durability, distance, and eco-friendly designs, present significant growth opportunities. However, environmental regulations and sustainability concerns pose challenges. Key players like Callaway, TaylorMade, and Bridgestone continue to dominate, with emerging brands focusing on customization and advanced product features.

Lawrence John

Prudour

+91 91308 55334

email us here

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Sports, Fitness & Recreation

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release